How I 3x’d my pay and 26x’d my profit by getting back to basics

Jacqui Pretty had everything going for her as a solopreneur-turned-CEO of a six-figure business. At least, that’s what it looked like from the outside.

Her company, Grammar Factory, was bringing in more than $200,000 in revenue annually (and growing year-over-year). She had a team she trusted and a lineup of clients who were so happy with the work her team did, referrals were the company’s number one way of getting new clients.

She had even appeared on stage at entrepreneurship events, talking about the success of her business.

But behind the scenes, Jacqui was thinking seriously about closing Grammar Factory down.

“It was a shame, because running a business was always this really rewarding thing. I loved the challenge of it, I loved talking to customers,” she remembers.

There was only one problem: “I just wasn’t making any money.”

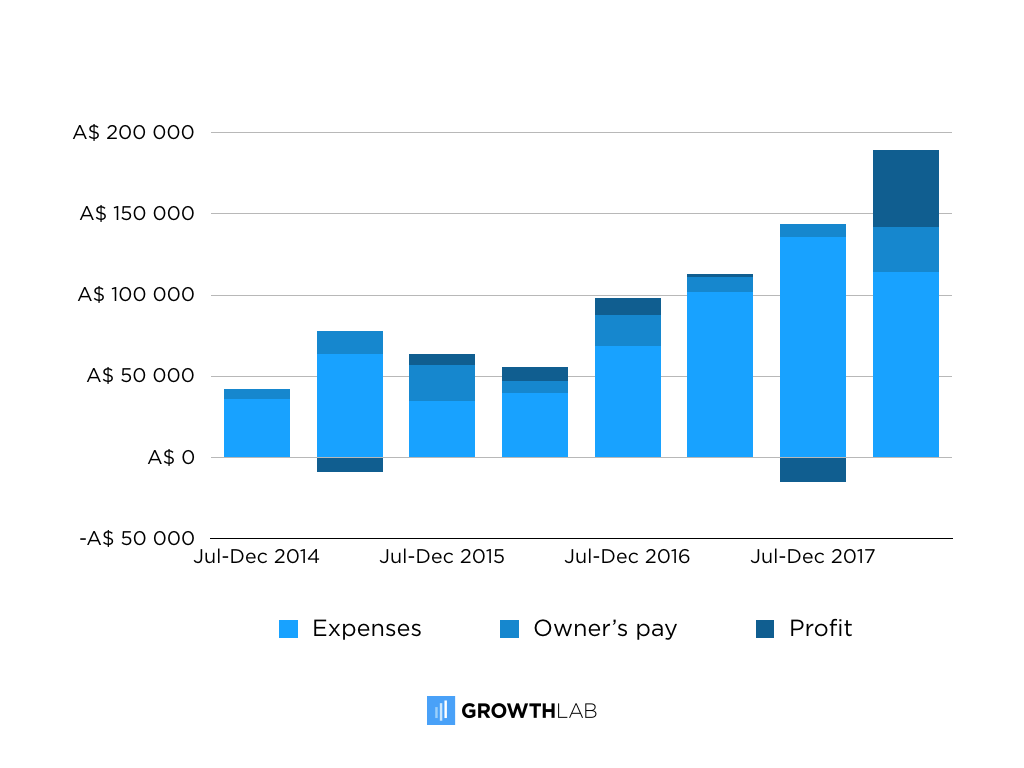

After paying her team and her vendors and covering the cost of various software programs (not to mention the expensive marketing consultants and business coaches that she brought on in an effort to fix what was ailing her business), Jacqui was left with just $30,000 per year to take home herself — less than half the average salary in her hometown of Melbourne, Australia.

“I was looking at the numbers thinking, ‘How can we have this service that’s so good, our clients always refer people to us, my team loves their work — how can all of this be working, yet I’m not paying myself, and there’s no profit, and if anything goes wrong, then we’ve made a loss for the month?’”

Before making the call to bring the lights down on Grammar Factory once and for all, Jacqui tried one last thing to inject life back into the business: she joined the test group for a new course for six-figure entrepreneurs that we were developing here at IWT called Double Engine Growth.

Flash forward 10 months, and the picture couldn’t be more different. These days, Grammar Factory is bringing in $30k in revenue per month and netting close to 25% in profit — and that’s after Jacqui pays herself a salary of 15%.

All of that — and Jacqui has shifted to only working on the business 10-20 hours per week.

What changed? Jacqui stopped chasing flashy marketing strategies and took a good, hard look at the two factors that would actually make or break her business: the money coming in, and the money going out.

“We haven’t changed the service. We haven’t changed the target market,” says Jacqui. “All we’ve done is change the numbers that sit under it, and it’s transformed the business.”

Paying her team first — and herself barely at all

When Jacqui started making the adjustments that would change the trajectory of her business, she had already been running Grammar Factory for four years.

The business started as a solopreneurship. But within a year, as word-of-mouth spread and clients started to pour in, Jacqui ran into a problem that all six-figure entrepreneurs run into sooner or later (service-based entrepreneurs sooner than most): there were so many customers — and only one of her.

So, Jacqui did the next logical thing: she started hiring, bringing on highly skilled editors and designers, and teaching them the unique approach to book editing that her clients came to Grammar Factory for.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

But as her team grew and the number of projects they could take on grew with it — so did expenses.

“Paying my team has always been important to me, because I’m expecting a lot of them,” Jacqui says. “The least I can do is make sure they get paid well and on time.”

But once Jacqui was done making sure her team got paid well and on time, there was nothing left for her. And that was a problem — not just practically, but personally as well.

“One of the big parts of running a business, for me, was having the freedom to live more freely, work anywhere, choose the lifestyle I wanted,” she says. “But money funds freedom. Especially living in Melbourne, which is one of the most expensive cities in the world. I was really just treading water.”

Looking for advice, then getting it — and regretting it

Jacqui knew that if she was going to continue to run Grammar Factory, something needed to change. So she started looking for advice geared toward helping a six-figure entrepreneur get her business back on track. But that advice was hard to come by.

“There’s plenty of information out there on getting started — finding freelance work, launching your first product, marketing advice — but very little on what comes after your business has hit $200k+ in revenue.”

Eventually, Jacqui landed on what she thought might be the solution: one-on-one, personal attention from a series of business coaches.

“I sought out coaching a couple of years in a row. And both times, what the coaches told me was, ‘You need to look at your funnel, to actively bring in new customers rather than relying on referrals.’”

So Jacqui took the advice that her business coaches dished out. She put on a live event, complete with an email marketing and social media advertising campaign leading up to it. She even went as far as to seed the crowd with friends and former clients, just to ensure she’d be talking to a full house.

“A week out I was calling people up like, ‘Please just be a butt on a seat so I have more people in the room,’” she remembers.

Then, showtime: the day of the event arrived, Jacqui got up, and made her pitch — and the results were … underwhelming.

“I just didn’t get enough people,” she remembers. “I think I got three or four who wanted to sign up, which is what you expect — but that wasn’t enough for me to run the program. So all of that money that I had put into that day and into the marketing leading up to it was just gone.”

Jacqui didn’t just go through this expensive, time-consuming process once. She did it twice.

“I did that in 2016, then I had this one-day business breakthrough kind of program with a coach last year, and he actually recommended the same strategy. So I did it again, and spent all that money again.”

In hindsight, Jacqui can see there were two main problems with the advice that these coaches were giving her.

“On the one hand, the strategies they recommended were increasing the expenses of my business quite a bit, which was making it more unhealthy. And then the advice was all focused on volume and generating more business, rather than looking at the underlying model.”

Squeeze all of the juice out of what you already have

After her misadventures with coaching, Jacqui began to think that the only possible way to keep running her business was to tear it all down and start over from scratch.

But once she started exploring some of the ideas from Double Engine Growth, “The message I got immediately was, ‘No, don’t do that,’” she remembers. “You already have a model that drives revenue.

Why would you throw that out and start something brand new? If you’ve got something that works, keep doing more of it. Keep doing more of what works until it doesn’t work anymore. Don’t jump onto a new thing until you’ve squeezed all of the juice out of what you’re already doing.”

With a talented team, happy clients, and a high-quality product, there was still plenty of juice to be had in what the Grammar Factory was already doing. All Jacqui had to do was figure out how to squeeze it — which she did, by making two changes to the underlying financials of her business:

- Cutting expenses that were taking up budget without providing value in return

- Raising her prices to a point where there was a healthy amount of profit left over after expenses

Change #1: The expenses are too damn high!

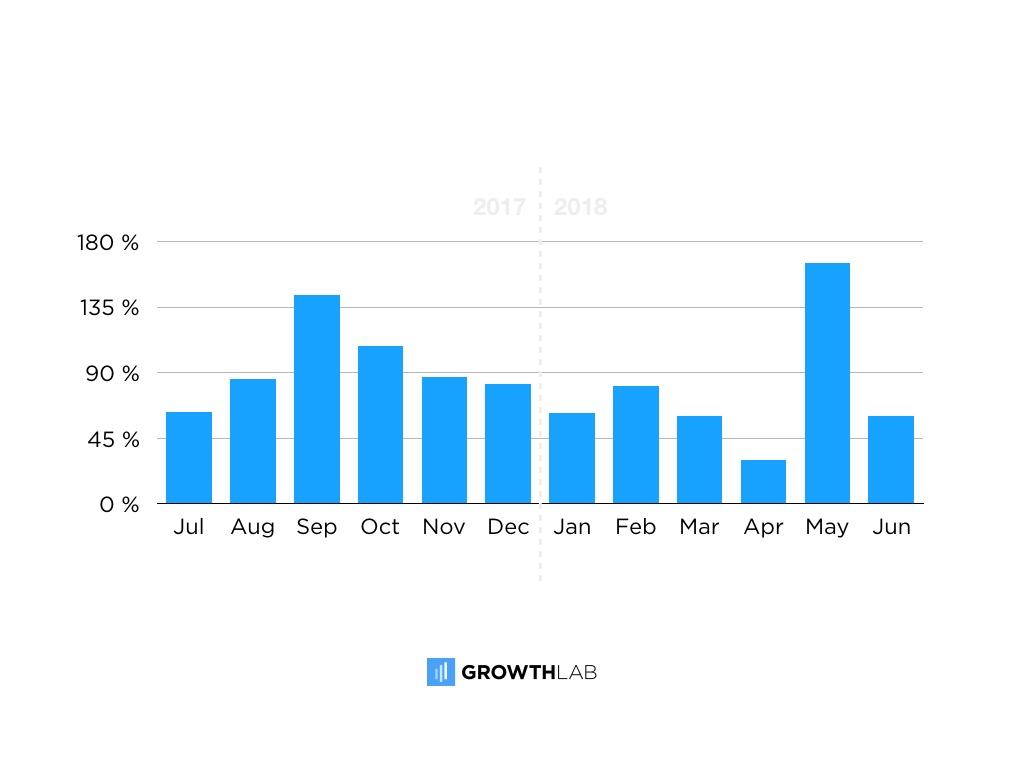

Jacqui didn’t need to be told that Grammar Factory’s expenses were insane. That was pretty apparent. “At the end of 2017, my expenses looked something like: October, 108%; November, 87%, December 82%.”

But for a long time, Jacqui had assumed that was just how it was in the publishing biz. “I thought I was charging as much as I could, and there was nothing I could do about expenses.”

It wasn’t until Jacqui read the book Profit First, and got perspective about what a financially healthy six-figure business should look like, that she started to rethink her assumptions.

“What I learned is volume isn’t going to fix a bad business model,” says Jacqui. “You’ve got to get the underlying numbers right to begin with.”

The financials are like the vital signs of a business. And just like a healthy human temperature is 98.6°F, give or take a couple degrees, there are “healthy” and “unhealthy” breakdowns of how your company’s revenue is getting allocated.

Want to build a business that enables you to live YOUR Rich Life? Get my FREE guide on finding your first profitable idea.

For Grammar Factory’s revenue level — between $250K and $500K after taxes — Profit First recommends allocating your business’s funds like so:

Profit: 10%

Owner’s comp: 35%

Owner’s tax: 15%

Operating expenses: 40%

“Seeing what my business should look like from a financial perspective got me to the point of realizing, ‘It’s not worth continuing to run it this way. Either I need to look at our expenses and change them quite drastically, or I need to stop.’”

Slashing her business’s expenses in half might sound like an impossible feat. But once Jacqui got started, she was able to make progress quickly.

“As soon as I sat down and really looked at the numbers, expenses dropped to about 60%,” Jacqui recalls. “And all of a sudden there was an extra 30% cash flow in there as soon as I got the numbers right.”

As for what exactly she cut? “I was still paying for a number of marketing things, like running events and doing Facebook ads. I actually hired a consultant at one point to help with the marketing.

At one point I realized, ‘You know, most of our business comes from referrals anyway, we don’t really need this part.’ There were a lot of things like that, that were adding to our costs without delivering the value.”

In its new, leaner form, Jacqui’s budget is laser-focused on one thing and one thing only: delivering top-level services to Grammar Factory clients.

“Pretty much everything we pay for now is directly tied to editing and publishing books — our editors, our designer, our distributor. And then there are the ongoing software required to keep our business running, like eSuite for Business and Zero and ActiveCampaign. Beyond that, there really isn’t anything else. It’s a much leaner business.”

Jacqui knows there’s still progress to be made on the financial front. But the numbers are finally headed in the right direction.

“One of my goals is that I want three months’ worth of income just as a buffer. We don’t have that yet, but we’ve got one month, which is great. That means, if a client is late with their invoice, it doesn’t mean I pay a staff member late. It means everyone on my team, all of our suppliers, everybody gets paid on time. Having that extra money sitting there means that’s never in question.”

Change #2: Finding out what the market will bear

There’s a limit to how much you can cut — but there’s no limit to how much you can earn. Cutting expenses is great … but there’s only so much you can cut before you hit bone. If you really want to change your financial situation, the number you need to look at is the amount of money coming in.

In the world of entrepreneurship, that means one thing: Raising your prices.

And Jacqui had done that — pretty regularly, in fact, since she launched the business. What she realized was that she was going about it the wrong way. “The mistake I made in the past was doing it incrementally, to the point where it wasn’t actually making a difference,” Jacqui says.

A 10% price increase on a $1,500 product is a nice little raise if you’re a solo entrepreneur. But when you have a team to pay and services to cover, “a 10% increase isn’t going to make that much of a difference,” says Jacqui.

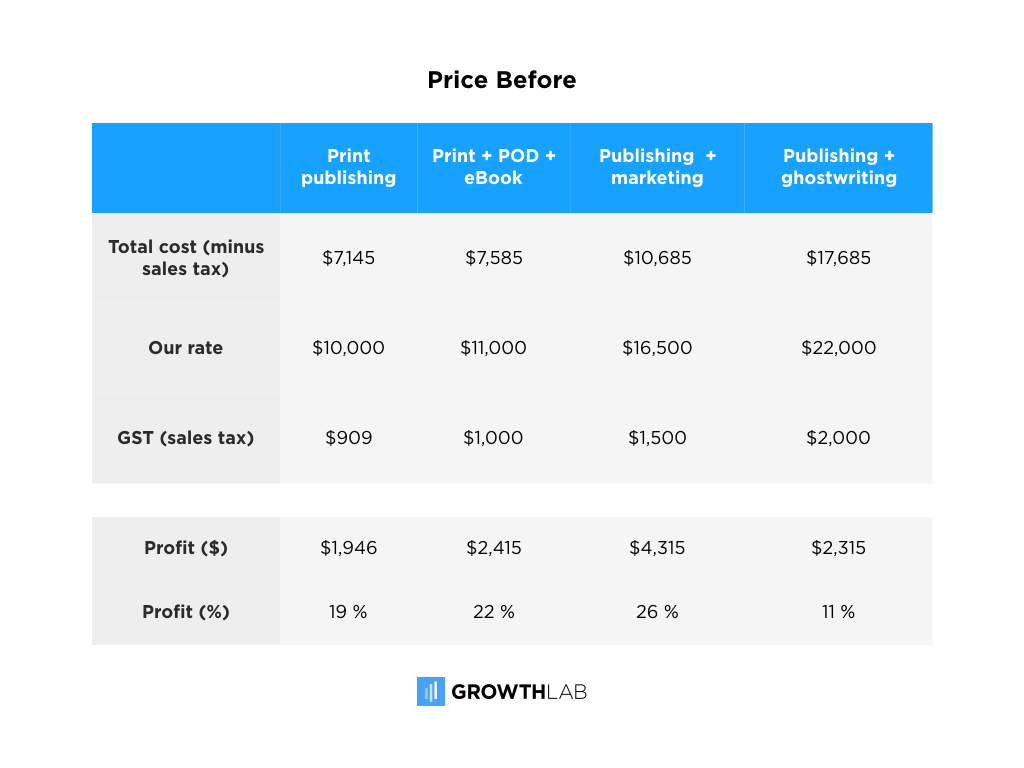

So Jacqui got to work figuring out exactly what she would need to charge in order to hit the recommended profit levels laid out for her level of revenue in Profit First. “I went back to my spreadsheet, and I figured out what we needed to be charging to make a profit of between 40% and 50% from each of our main services.”

The result was a pretty drastic price hike. Jacqui took the price tag on Grammar Factory’s marquee service — a book publishing package that takes books all the way from editing through printing, e-book creation, and distribution — and raised it from $11,000 to $18,000.

The thought of a price hike that drastic would strike fear into the hearts of a lot of entrepreneurs. But Jacqui realized that, if she wanted to save her business — this business — this was what she needed to do. Whether it worked or not.

“What I realized was, if the price increase didn’t work, then the business didn’t work, and it was better to find out now than to spend another five years below the poverty line, not living the life I wanted.”

Nothing sexier than a strong foundation

The good news: the price increase worked. A year after Jacqui was contemplating shutting down Grammar Factory once and for all, the business is healthier than it’s ever been.

And Jacqui isn’t chained to her desk, endlessly crunching numbers to make it happen.

“I’ve joked about loving my spreadsheets, which I do — but it’s not like I’m constantly looking at the numbers … But just making a couple of sweeping changes when it came to my finances has made tens of thousands of dollars difference to my business a year.”

In the first half of 2018 alone, these two simple fixes — raising prices and lowering expenses across the board — have helped Jacqui to 3x her own pay (from $9,200 to $28,000) and 26x Grammar Factory’s profit (from $1,800 to $47,000) over the same time period last year.

And those sweeping changes are making themselves felt in Jacqui’s personal life, as well. “It’s fun seeing the numbers go up, and then realizing what that gives you,” she says.

“I was able to fly business class for the first time earlier this year, which was super fun. And, yeah, if I was doing a big sexy marketing campaign, or doing a new book launch, that would look much sexier. But I would be flying economy.”

After five years of running Grammar Factory, Jacqui has finally found the freedom that was the reason she started her own business in the first place.

“I’m essentially running the same business that I was eight months ago — the upside has just gone through the roof. I just needed those couple of tweaks to make it work.”