4 secrets to building your most profitable business (that GREATLY improve your odds of success)

When you’re thinking about starting a business, it’s only natural to want to build the most profitable small business you can.

Running a profitable business comes with all kinds of benefits on a personal level: flexibility, control over your time, not to mention the peace of mind of, you know, earning money.

Here at GrowthLab, we’ve helped thousands of entrepreneurs start and grow profitable businesses. In the process, we’ve noticed a few things that set the most profitable businesses apart. In this post, we’ll look at what those traits are — and how to incorporate them into your own business:

Profitable small business tip #1: Start with a profitable idea

Profitable small business tip #2: Charge what you’re worth

Profitable small business tip #3: Plan expenses strategically

Profitable small business tip #4: Make profit a priority

But first, a couple of important definitions to know:

Having revenue — money that customers pay you in exchange for what you offer — means that what you’ve created is valuable enough to your audience that they’re willing to pay for it.

Having profit — money that’s left over after you’ve taken care of all the costs of your business — means that you’ll be able tokeepdelivering that value to people for a long time to come.

Profitable small business tip #1: Start with a profitable idea

The first trait that the most profitable small businesses have in common: they start with a profitable idea.

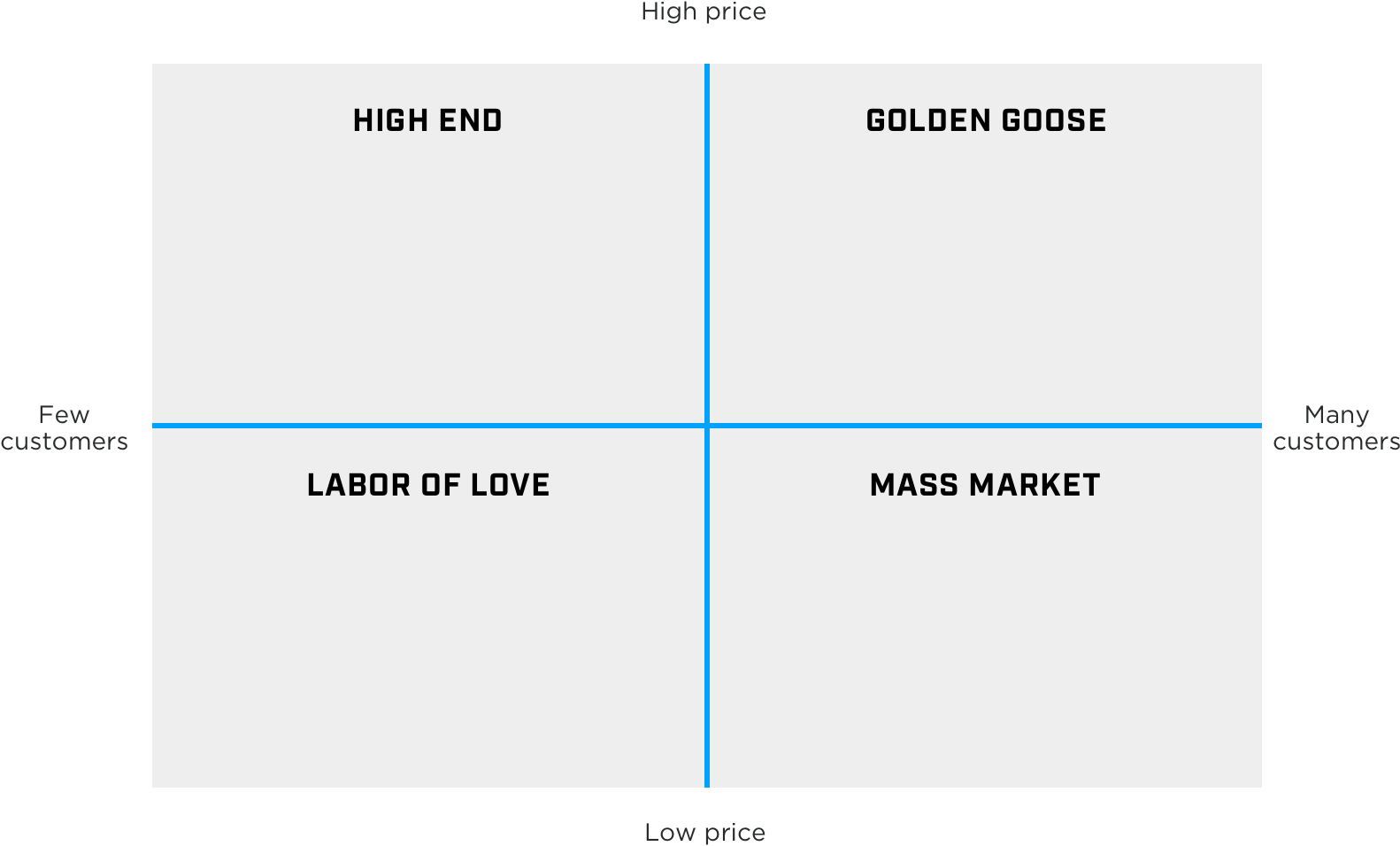

There are two main ingredients that determine the earning potential of an idea:

- How much you can charge (the price)

- How many potential customers there are (your demand)

Multiply these two factors together, and what you get is your business’s earning potential.

Price X Demand = EARNING POTENTIAL

In our online courses about starting an online business, we have an exercise that helps students estimate the profitability of potential business ideas — before they devote time and effort to building them. It’s called the Demand Matrix.

Imagine all the business ideas in the world, laid out on a grid by their demand and price. Something like this:

Let’s tackle the options one by one:

- Mass-market ideas are products where there are a lot of potential customers, but the price isn’t that high. Most of the products we consume on a daily basis fall in this category.

- High-end ideas are ideas where the number of potential customers is relatively low, but you can command a premium price. Think about luxury brands like Ferrari, Rolex, andLouis Vuitton — those are all examples of high-end products. Not many people can afford these brands’ sky-high prices — but those who can afford it are willing to pay top dollar, because they associate the brand with luxury, and above all, quality.

- Labors of love are ideas where both price and demand for the idea are low. For example, our CEO, Ramit Sethi, loves ironing. Ramit is super passionate about ironing. Ask him about it, and he could give you a lengthy lecture about proper ironing technique. But would many people be willing to pay for an online course about ironing? Probably not. That’s not to say you can’t pursue a business idea that’s a labor of love. But if you’re prioritizing profitability, it may be a good idea to look elsewhere.

- Golden goose ideas have both a lot of customers AND can command a high price. A prototypical example of a Golden Goose business is Apple. The tech company has both millions of customers around the world, and they’re able to charge a premium price for their product — many hundreds and sometimes even thousands of dollars.

What we’ve noticed here at GrowthLab is that the most profitable businesses tend to fall in this last category: the golden goose.Entrepreneursin this category identify burning pains that a lot of people are willing to pay a lot of money to solve.

A few examples of golden goose ideas that solve burning pains for their audience:

- Seth Godin’s AltMBA. Career advancement is a huge market, with lots of customers who are looking for advice, and ready to pay a premium for advice they believe gets them the results they want. AltMBA costs participants $3,000 to join and has been taken by more than 2,300 students. That’s $6.9 million in revenue.

- Steve Kamb’s Nerd Fitness.The company for “nerds, misfits, and mutants” has served 40,000 students through their flagship course, Nerd Fitness Academy.

- Jenny Blake’s Life After College. Anybody who’s ever been a recent college graduate knows exactly how painful that experience can be, particularly when your path from college to career is not very clear. Jenny Blake charges $995 for her Career Pathfinder course, which helps young adults chart their way through these uncertain waters.

You can take any business idea you have and estimate its profitability by plotting it on this chart. Just think about your idea (or ideas — if you’re like a lot of entrepreneurs we know, you have more than one) and ask yourself two questions:

- Roughly how many people are out there who would be interested in this idea?

- About how much money would they be willing and able to pay?

The takeaway: The most profitable businesses start with a profitable idea: something that a lot of people will be willing to pay a lot of money for.

Ready to take control of your finances (without tedious budgeting?) Get the first chapter of Ramit Sethi's NYT Bestselling Book below.

Profitable small business tip #2: Charge what you’re worth

Pricing is a place where a lot of beginner entrepreneurs can run into trouble. When they do, it comes down to one simple problem: under-charging.

Too often, entrepreneurs assume that the best way to price their product or service is to look at what their competition is charging. They may even feel guilty for having the audacity to ask for money in the first place, so they keep their prices low, almost as a way of apologizing for charging in the first place.

GrowthLab hasn’t always been immune to the impulse to undercharge, either. When our CEO, Ramit Sethi, created his first product in 2007, he charged $5 for it — and, as he’s written, he was terrified of charging even that.

With time, though, Ramit’s thoughts about pricing changed. He realized he could charge more for his products — as long as the quality of what he was delivering justified that price. The more value he provided — the better he got at identifying meaningful problems that his audience was having and providing top-notch solutions to those problems — the more he was able to charge.

Today at GrowthLab and our sister site I Will Teach You to Be Rich, we have products that cost $1,000, $2,000, even $10,000.

What Ramit and our team realized: pricing is strategic. It’s a reflection of what your audience will be willing and able to pay, sure. But it’s also a reflection of what you think your product is worth, and how much value you think your audience will get out of what you have to offer.

A few examples of small business owners who charge premium prices for their products:

- Shirag Shemmassian charges $2,999 and more for college and grad school admissions consulting services at Shemmassian Academic Consulting. It might seem like a lot of money on the surface, but consider the target market: Shemmassian’s customers are already planning to spend well into six figures on pursuing their professional degree — what’s another $6,999 added on to bolster their chances of getting into a school that will make the investment worth it?

- Sarah Jones charges anywhere from $3,800 to $7,000 for dating coaching services through her company, Introverted Alpha. That’s money her audience of thoughtful but romantically challenged men is willing to pay in exchange for help solving one of the most painful problems there is. To quote a response to a recent survey we sent our audience on spending, which mentioned Introverted Alpha specifically: “I’d been having a lot of trouble dating, and why on earth wouldn’t I use money I had in the bank to dramatically improve my results?”

The takeaway: If you want to run a profitable business, focus on creating high-quality, high-value products you can charge premium prices for.

Profitable small business tip #3: Plan your expenses strategically

Expenses are the other side of the coin when it comes to profit.

Expenses are not a bad thing. As the saying goes, you need to spend money to make money. Done right, business expenses are not money that you spend and then never see again — they’re investments that help grow your business beyond where it is now.

So in a world demanding that you buy every shiny new thing, how do you know which expenses will yield returns and which won’t?

Answer: focus your investments on two main areas:

- Growing your audience,because before people can buy your product, they need to know about it.

- Creating & selling your products,because in order to make money, you have to have something to sell.

In other words: if you’re going to spend money, make sure the thing you’re spending money on will help you earn money in return.

One of our students, Jacqui Pretty, experienced this firsthand with her business Grammar Factory. The company was clearing six figures in revenueper year.But after taxes and expenses, there was barely anything left for Jacqui to take home herself.

The culprit: too many unnecessary expenses in her business.

After sitting down and taking a serious look at her expenses, Jacqui made two key changes that completely transformed her business:

- She increased the amount she was charging for her services by approximately 50% across the board.

- She cut expenses that weren’t meaningfully contributing to what her company was earning, including expensive marketing consultants and elaborate live events that didn’t bring in enough new customers to warrant the expense.

With just those two changes — not changing anything about the product or her team — Jacqui was able to boost Grammar Factory’s profits to close to 25% — and that’s after she paid herself a salary of 15% as the owner.

The takeaway: Be strategic about managing expenses in your business. Know why every expense is there, what it’s for, and what results it’s producing.

Profitable small business tip #4: Make profit a priority

We have a saying here at GrowthLab and our sister site, I Will Teach You to Be Rich: “Show me your bank account, and I’ll tell you what your priorities are.”

Take a look at the bank accounts of the 60% of small businesses that are unprofitable and you’d see: they’re not making profit a priority.

To be clear, the problem isn’t the entrepreneurs themselves. The problem is how traditional business accounting advice trains us to think about the relationship between the three pieces of the profitability puzzle: revenue, expenses, and profit.

One of our favorite thinkers on the topic is Mike Michalowicz, author of the must-read business finance book Profit First.

As Michalowicz explains, the traditional formula for calculating profit looks like this:

Sales – Expenses = Profit

Michalowicz flips the traditional formula completely on its head:

Sales – Profit = Expenses

Instead of startingwith expenses and endingwith profit, he advises, put profit first.

Start with the amount of money you earn. Then put aside a set portion of those earnings as profitfirst, before you cover expenses.

It’s a lot like personal finance, where the best practice is to put away money for retirement and other savings goals before you cover rent, groceries, and other expenses. If you put the money away at the beginningof the month, you won’t be tempted to spend it at the end.

As for how muchprofit you should set aside? Michalowicz covers that, too. Here’s the breakdown he recommends for businesses earning up to $250,000 in revenue:

Profit: 5%

Owner’s pay: 50%

Tax: 15%

Operating expenses: 40%

As the amount of money you’re bringing in grows, the percentage you set aside for profit grows with it. At $250K – $500K, it increases to 10%, and so on.

The takeaway: If you want to make profit a priority in your business, put profit first. Set aside a set percentage (start with 5%) of profit before you deal with expenses and keep that money earmarked specifically as profit.

Start YOUR profitable online business

You’ve seen the traits that set the most profitable small businesses apart. Why not apply that knowledge to a business idea of your own?

To help you, I want to give you our Ultimate Guide to Profitable Business Ideas.

In the guide, you’ll learn:

- How to start a side business no matter your current situation (working full time, busy family, crazy schedule, student)

- The 6 types of businesses you can start online and how to decide which one is right for you

- How to discover if your business idea will make money BEFORE spending any money

- The 5 things you need to go from $0 to $4,500 online, faster than you ever thought possible